Investing in Rare Earths : Time to Take Profit?

Back when the US Presidential Election was in progress last year there were a few investments that I was considering depending on the outcome of the election. One of those investments was Rare Earth Minerals. I knew that China had a massive market share of Rare Earths and I also knew that the incoming president was likely to be pushing tariffs against Chyna and the likely result of this was that Chyna would retaliate by restricting supply in some way…

Source

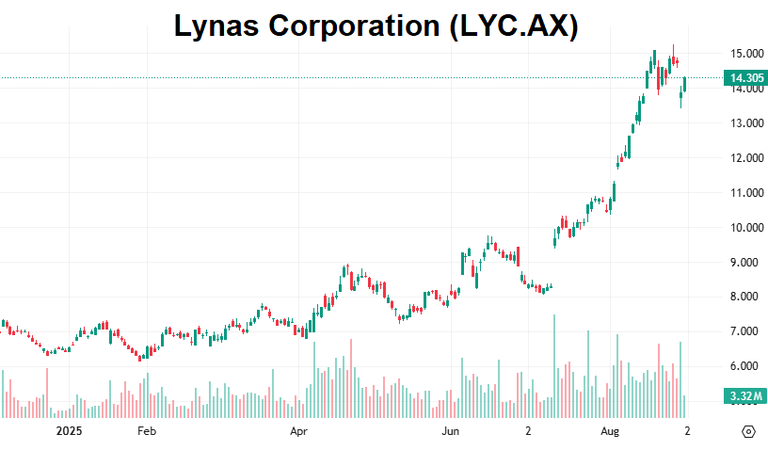

So I looked up Rare Earths Producers in Australia and found Lynas Corporation which claims to be ”the world’s only significant producer of separated rare earth materials outside of China” and thought it might make a good investment. I bought some shares back in late 2024.

Since then we’ve seen the whole tariff thing blow up, followed by talk of US buying Greenland for access to rare earths (among other things), we’ve seen talk of making deals in Ukraine for getting access to rare earths (among other things) and now we’re finally seeing China putting a ban on rare earth exports. None of this is particularly surprising, but after getting the speculation about what might happen right has this investment played out and is it now time to sell the news?

My shares in Lynas Corporation (LYC.AX) have exploded over the last 2 months and my investment today is up significantly. The Lynas Corporation is making headlines of its own with mainstream outlets and alt-news too. Yesterday ZeroHedge reporting that Australia's Largest Rare Earth Miner Plans US Expansion To Compete With China. There is talk of fresh fundraising at the same time as the company has reported net profit falling to A$8 million from A$84.5 million a year ago. The signals are mixed, the price is volatile and the chart looks to me like it might be a bit toppy.

I don’t like it when companies talk about issuing new shares (capitalising on heightened valuations) and I don’t like it when there is a lot of hype around my investments, so today I’ve decided to sell and shift those funds back into Gold. I might be missing out on another big leg up with LYC but I know not to be greedy. I am getting quite bullish on Gold again so this switch makes sense to me.

With the ai boom it's most likely that we will see more demand for rare earths, it also depends on ukraine war, as long as it lasts they can't be mined there

keep the good work up

I always believe in taking some profits to at least cover your initial investment then you're playing with house money. It's always a gamble, their price might go absolutely crazy or with the new shares it could drop like a rock. Plus in the US they are streamlining rare earth mining so eventually that may affect prices, and I'm sure that's why they are expanding to the US. Either way, good luck, rare earths are a great sector right now!

Great call. And yes I would pull all of my profit if larger then my original buy, but would keep my initial dollar investment in it just for the chance of another ride.

Taking profits when the hype is at its peak and switching to gold seems like good risk management, I think it's really interesting.

So many great opportunities, it's all about timing. !BBH !DUO

You just got DUO from @gratefuleveryday.

They have 1/1 DUO calls left.

Learn all about DUO here.

wow, yea. good time to take profits. maybe sell half or so.. 😉👊