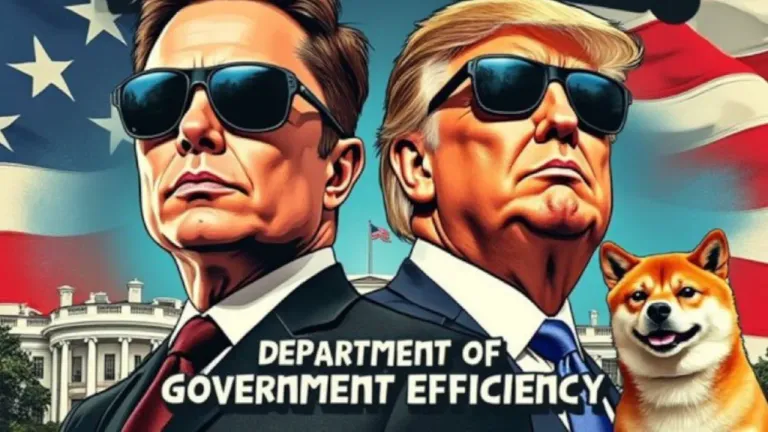

Department of Government Efficiency Cancels 315,000 Federal Credit Cards in Cost-Cutting Sweep

Department of Government Efficiency Cancels 315,000 Federal Credit Cards in Cost-Cutting Sweep

In a bold move to curb federal spending, the Department of Government Efficiency (DOGE), an advisory body established by President Donald Trump and led by Elon Musk, has deactivated approximately 315,000 government-issued credit cards as part of a sweeping cost-savings initiative. The announcement, made in late March 2025, marks a significant escalation in DOGE’s mission to root out waste, fraud, and inefficiency across federal agencies, sparking both praise and controversy as the cuts ripple through government operations.

A Five-Week Audit with Major Impact

The cancellations stem from a five-week pilot program launched earlier this year, targeting unused or unneeded credit cards across 16 federal agencies. According to DOGE’s updates, the effort has slashed a substantial portion of the 4.6 million active cards identified at the program's outset—cards that collectively processed over 90 million transactions worth roughly $40 billion in fiscal year 2024. By March 26, 2025, DOGE reported that up to 315,000 cards had been either canceled outright or restricted, with some agencies seeing limits slashed to just $1 per card.

The Interior Department and the Department of Health and Human Services (HHS) led the pack in sheer volume, with nearly 20,000 purchase cards and 40,000 travel cards deactivated at Interior, and over 43,700 travel cards plus 2,235 purchase cards cut at HHS. Other affected agencies include heavyweights like Homeland Security, Treasury, NASA, the Environmental Protection Agency (EPA), and the Department of Agriculture, alongside smaller entities like the Office of Personnel Management and the Social Security Administration. Notably, the State Department emerged as the only one of the 16 audited agencies to escape unscathed, retaining all its cards.

The Backdrop: A $40 Billion Spending Footprint

DOGE’s focus on credit cards isn’t arbitrary. In February 2025, the group revealed that the federal government’s 4.6 million active cards—used for everything from travel expenses to office supplies and emergency purchases—had racked up a staggering $40 billion in spending over the previous fiscal year. The Department of Veterans Affairs topped the list at $17.3 billion, followed by the Defense Department at $11.2 billion, with Justice and Homeland Security each exceeding $1 billion. Smaller agencies collectively accounted for another $2.3 billion. With an average transaction value of $441 (per General Services Administration data), the sheer scale of this spending provided DOGE with a prime target for reform.

The initiative gained momentum after Trump’s February 26, 2025, executive order, which froze all federal employee credit cards for 30 days—except for those tied to disaster relief or critical services—and empowered DOGE to oversee spending practices. The order framed the cuts as a step toward “transforming federal spending” and ensuring accountability, aligning with the administration’s broader goal of trimming $2 trillion from the federal budget to offset proposed tax cuts.

Mixed Reactions and Operational Fallout

While supporters hail the cancellations as a victory against government bloat, critics warn of unintended consequences. DOGE’s rapid pace—deactivating 200,000 cards in just three weeks by mid-March, then climbing to 315,000 by late March—has left some federal workers scrambling. Reports from agencies like the FDA and USDA highlight delays in ordering basic supplies, such as lab equipment and reagents, while National Park Service staff have canceled critical maintenance trips. At the FAA, employees fear stalled aviation projects, with one worker noting, “We’re allowed to use personal cards in emergencies, but no one trusts reimbursement now.”

The $1 spending cap imposed on some surviving cards has drawn particular ire. An EPA employee described resorting to “bartering” for liquid nitrogen to preserve samples, while an NIH researcher paused vaccine experiments due to supply shortages. Critics argue that such disruptions undermine essential services, potentially outweighing any savings. Defenders, however, point to past watchdog reports of misuse—like Lego sets and lavish meals charged to government cards—as justification for the crackdown.

Savings vs. Uncertainty

One glaring question remains unanswered: How much money will this save? DOGE has yet to quantify the financial impact, a silence that has fueled skepticism on platforms like X, where users demand concrete figures. With $40 billion in annual card spending as the baseline, even a 10% reduction could yield $4 billion—but without official data, the true benefit remains speculative. Meanwhile, the program’s legal footing faces challenges: a March 24 court ruling blocked DOGE from accessing Education Department records, citing privacy concerns, signaling potential roadblocks ahead.

What’s Next for DOGE?

With 4.3 million cards still active and DOGE vowing “more work to do,” the initiative shows no signs of slowing. Musk, who has hinted at “shady expenditures” in government ranks, aims to deliver $1 trillion in savings by July 4, 2026—the nation’s 250th anniversary. Whether this aggressive pruning will streamline government or paralyze it remains a contentious debate, but for now, 315,000 fewer credit cards are in play—a tangible, if polarizing, step in DOGE’s quest to reshape federal efficiency.

Congratulations @cryptoace33! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 300 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: