Thoughts on a Universal Basic Income in the United States

Summary of UBI as described by Dr. Trost

How Would it Work?

To begin this discussion, I would like to summarize the key tenets of Universal Basic Income as proposed by Dr. Trost, a professor of Entrepeneurship at Oklahoma State University.

Constitutional Amendment: For starters, the UBI would be enshrined in the constitution which is much harder to modify by electioneering politicians than public policy.

Revenue: Monetarily, total federal government taxation would be capped at 25% of the US GDP with federal spending capped at 9%. The remaining 16% would then be redistributed to citizens via monthly UBI. The United States would also do away with the current tiered income tax system and introduce a 25% flat tax for all income.

Who: All US citizens would be entitled to the UBI regardless of age. Presumably the UBI of minors would be paid out to their parents with payments switching to that individual at the age of 18.

Policy: Per Dr. Trost, all parts of the federal government budget that are allocated to medical care, social security, and other general welfare programs could be cut. Furthermore, all government subsidies of corporations would cease with no further “bailouts” for companies that we currently would consider “too big to fail.” Additionally, minimum wage would be abolished as the UBI would serve as a safety net for low skilled laborers.

Positives of the Libertarian UBI Approach

One of the most beautiful things about UBI is that it would not interfere with the efficiency of the free market. Since the government is not providing commodities to at-risk communities, individuals can spend that money in the free market to meet their needs as they see fit. This could lead to increased competition in low-income oriented businesses reducing costs.

Another great thing about UBI is that it would eliminate the benefits cliff that people currently face with many federal welfare programs. Since the UBI is received regardless of the income level, people would not have to worry about potentially ending up poorer for taking a job and moving to a higher income tax bracket. With the 25% flat tax, it would act as a negative income tax for an individual making less than $36000 a year or for a family of four making less than $144000 annually.

UBI could help incentivize entrepreneurship. On an individual level, one of the primary barriers to starting a business is the high amount of risk that an individual must take on. With a monthly UBI, the damage of failing is lessened as a person would have some money to cover their basic needs and expenses. Once the business was up and running, it would provide a small additional revenue stream to invest in that business.

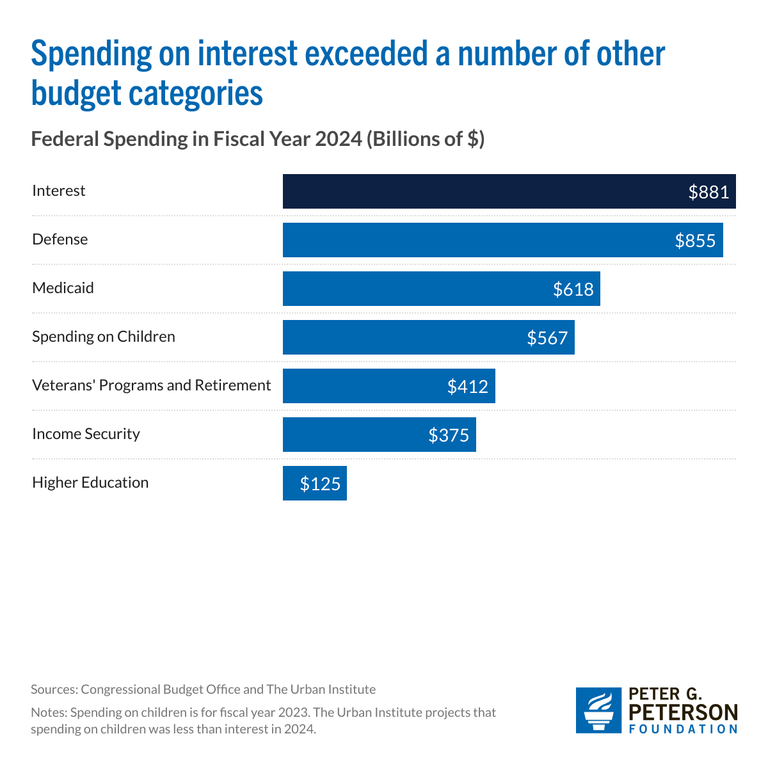

Capping US government expenditures would serve as an effective means to lower the national debt. If the current track is not reigned in, the US Congressional Budget Office estimates that interest on the national debt will exceed the revenue earned in the United States. As it stands already, the United States spent more money on interest than the entire defense budget.

Potential Issues with a UBI

Paying for It

One of the biggest issues with a UBI would just be paying for it. Dr. Trost proposed that 16% of the United States GDP could be allocated toward this end. Based on a flat $9000 per citizen (not including the 150% given to the elderly) would result in an estimated cost of around three trillion dollars. However, as it currently stands, the United States can only effectively raise 17% of the GDP in tax revenue. (per US Treasury in Fiscal Year 2024) Taxing the US GDP to 25% would mark a significant increase in taxes across the board disproportionally affecting the higher tax brackets. This would especially be true if capital gains tax were increased. While it makes sense to shift the tax burden up to higher income earning individuals, there is potential for capital flight especially amongst corporations as it would increase their tax burden by four percent. Enforcing a 25% flat tax while reducing the complexity associated with the tax system could potentially result in a necessary expansion of the IRS which may not be politically popular.

Inflation

A UBI has the potential to cause significant inflation. While it is true that the government would not just be printing money, the UBI concept presented by Dr. Trost would serve as a tool of wealth redistribution from the richer elements of American society to poorer people. The poorer individuals who receive these payments are much more likely to spend them on the goods they need for day-to-day life. A guy who makes 100 million dollars a year is not likely to spend 25 million dollars of that money on essential items like food, toilet paper, gas, etc. However, if that 25 million dollars is taken from him with a 25% tax and redistributed to people who make $38k a year (median US income), the odds are that much more of that 25 million dollars will be spent on necessities. This has the potential to cause demand-side inflation, much like what we saw with the COVID stimulus funds.

Danger in Times of War

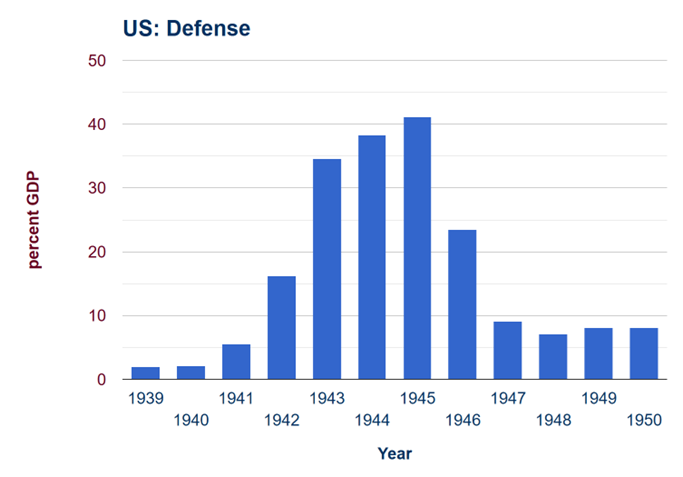

If a constitutional amendment was passed limiting American spending to a flat 9% of GDP, this could pose a significant obstacle in a time of war. As seen from the chart below, in the war-time economy of WWII the United States at one point spent over 40% of the GDP on Defense. An obvious way around this issue would be to make the constitutional amendment only apply in times of peace; however, from a federal government perspective, this could incentivize Congress to declare war, Doing so would increase the amount that they are allowed to spend and by extension their power.

Conclusion

There are several more potential pitfalls of the UBI that I did not have time to address such as potential abuses of the program via birthright citizenship, the chance that individual states have to increase their tax rates to offset the lack of federal funding that they are receiving, and the danger of abolishing all forms of welfare services such as addiction counseling service. Furthermore, the UBI is nowhere near enough to offset the ridiculous cost of medical care in the United States. A UBI may have the potential to offer great advances and increase the standard of living for millions of Americans; that being said, if not managed well it could create a system ripe for exploitation on an individaul level. regardless, I think that it is important to acknowledge that the current system is broken, and it is only through daring and innovative ideas, such as a UBI, that we can forge a solution.