Crypto Gets CLARITY: Good or Bad?

The final, and perhaps biggest, bill to pass the US House of Representatives during Crypto Week last week was the Digital Asset Market Clarity Act of 2025, the CLARITY Act. This is supposed to make the regulatory landscape much clearer for the crypto space.

But does it actually help? Well, let's quickly dive in.

Big Picture, What Does CLARITY Do?

On the whole, CLARITY does three big things:

- Specifies criteria for which crypto assets are commodities and which are securities

- Designates the Commodity Futures Trading Commission to regulate commodities and the Securities and Exchange Commission to regulate securities

- Clears up the legality around certain crypto activity

The biggest issue in the crypto world in the US has been that, as a radically new industry, no one knew how it would be legally treated. This means that some people operated with full impunity, while others got capriciously cracked down on without knowingly doing anything wrong.

Well, now we get our CLARITY: we get explicit government involvement, but at least it's clear. Be careful what you wish for.

The Decentralization Test

The biggest part is the test and criteria that separate commodities from securities. The criteria for something to be considered a decentralized digital commodity, rather than a security, are:

- Value intrinsically linked to blockchain utility, rather than promises/efforts of promoters or ties to extrinsic assets. This means that the utility of the blockchain itself must give the value that people pay for, rather than some company or promoter promising to give it future value, or tying its value to something physical, such as ownership in shares of something.

- Blockchain must be "mature," i.e. decentralized and not under the control of one party or entity. This includes being open-source code, a fully open and impartial system, a largely functional blockchain/finished product, no one party in charge of governance, and no one entity having over 20% of either the voting rights or the coin supply.

This means that cryptocurrencies that appear decentralized, but have heavily-centralized elements such as a foundation or founder controlling most of the voting rights or a big chunk of the supply, would still be classified as securities. Assets like XRP would certainly qualify, though Ripple's deep pockets, good connections, and good lawyers may let them wiggle out.

Decentralized commodities would be regulated by the CFTC, including crypto exchanges, brokers, etc. having to register as Digital Commodity Exchanges and comply with their rules, including audits, record keeping, fair trading, anti-money laundering measures, minimum capital requirements, and so on.

Securities, meanwhile, would fall under the SEC's purview. This is the boogeyman that the crypto space has been fearing, though at least now, more deserving victims will fall under the SEC than the innocents caught up in their lawsuits previously.

Note that cryptos that start off as a security would have their initial sales classified and regulated as such, but they could later transition to a mature blockchain and therefore a commodity later. One could argue that, under this definition, something like Zcash's founding would be considered a securities offering (with 20% of the block reward going to a Founder's Reward and one company essentially running development), but now would be considered a decentralized commodity.

Is Clarity or Grey Area Better?

This really depends on who you ask.

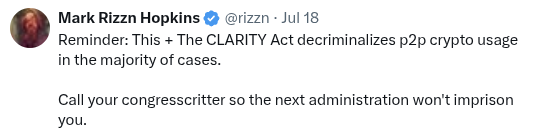

In the case of people like Mark Hopkins who went to prison for selling crypto peer-to-peer while under the impression that everything was legal, CLARITY is everything. Basically, it enshrines the right to self-custody, and exempts peer-to-peer trading from registration requirements as digital commodities brokers. etc.

Note that none of the above was explicitly legally criminalized before, but due to the grey area around the space, the government was able to selectively and capriciously interpret current laws to ruin the lives of people like Mark. Clarifying the rules makes such people no longer live in fear of ending up in prison based on the whims of whichever administration or prosecutor was in power at the time.

On the other hand, the Wild West days are over. Lots of cryptos will be designated as securities. It'll be very difficult to launch a new blockchain without the SEC breathing down your neck, and most decentralized ones will have been grandfathered in. But even decentralized ones will be much more regulated on exchanges than before. Gone are the days of any old exchange operating however they want, selling whichever coin they want, with anonymous user accounts, and so on. This is now a regulated industry with paperwork, legal fees, tracking on everything, and tight controls.

On the whole, CLARITY appears to be good for the crypto industry and businesses, and possibly good for crypto as a whole, but does involve government more than it was before. Which is not great, and certainly not as good as a fantasy land where we wouldn't have gotten any new legal restrictions on the new asset class at all. But, all things said and done, we're probably lucky that this is what we got.

Good for CLARITY.

Posted Using INLEO

https://www.reddit.com/r/CryptoCurrency/comments/1m8dcmh/the_final_and_perhaps_biggest_bill_to_pass_the_us/

This post has been shared on Reddit by @x-rain through the HivePosh initiative.

Congratulations @thedessertlinux! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 4000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: