The Bond Market’s “Higher for Longer” Era: What Could Go Wrong?

The Bond Market’s “Higher for Longer” Era: What Could Go Wrong?

If you’ve been paying attention to the financial headlines lately, you’ve probably noticed a recurring phrase: “higher for longer” when it comes to U.S. bond yields. That’s Wall Street speak for the idea that interest rates—particularly on government bonds—might not come down anytime soon. On the surface, this might not sound like a big deal. But dig a little deeper, and there are some very real risks worth watching.

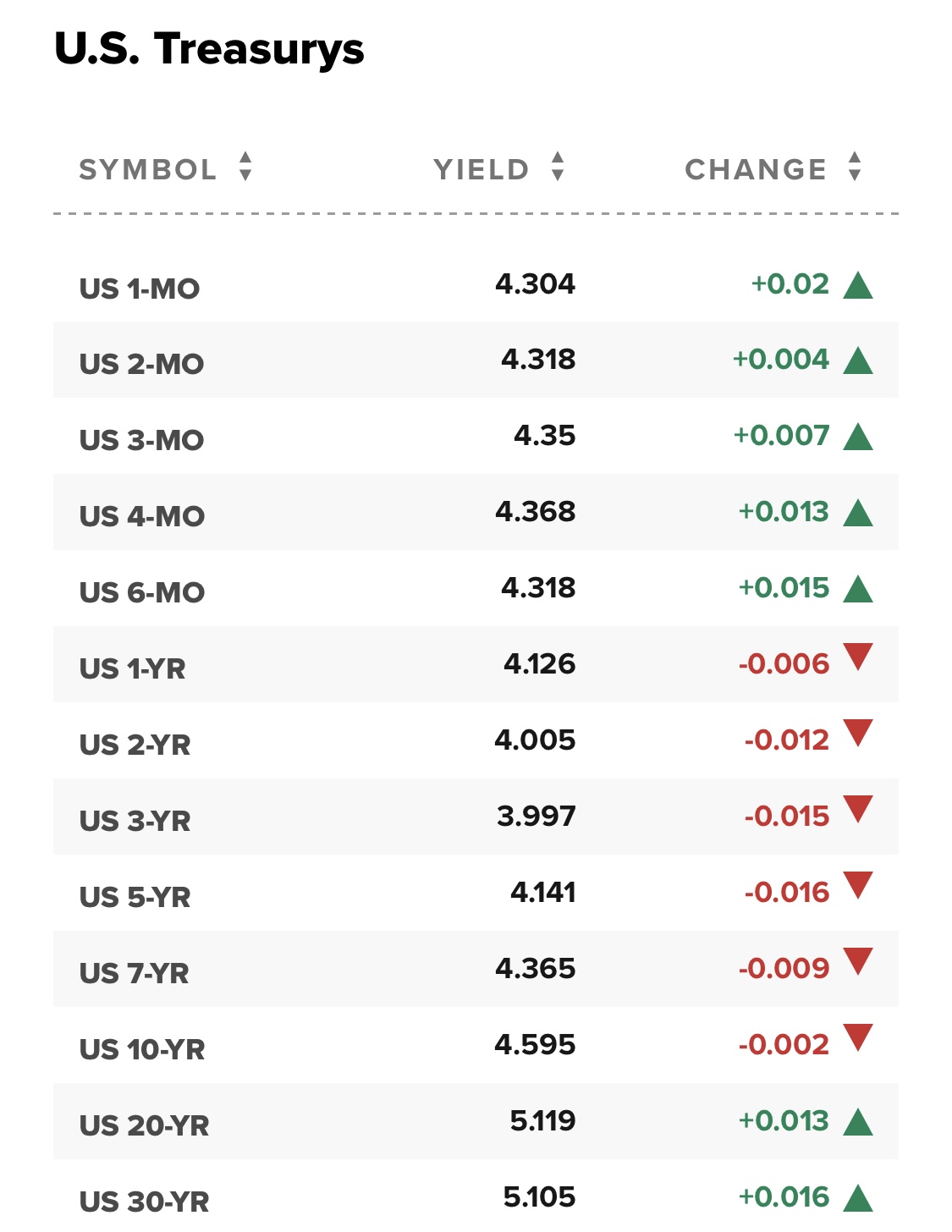

First, let’s break down what this means. Bond yields, especially on U.S. Treasuries, are heavily influenced by interest rate expectations. Since inflation has been sticky and the Fed remains cautious, the market is pricing in the idea that rates will stay elevated longer than originally hoped. That translates into higher yields on 10-year and 30-year bonds. Sounds okay, right? Savers are getting better returns, after all. But there’s a flip side.

Higher yields mean higher borrowing costs across the board. Whether you’re a homebuyer facing 7% mortgage rates or a business looking to finance a new project, elevated yields make it more expensive to borrow. For companies already carrying a lot of debt, refinancing is getting painful. For the U.S. government—sitting on a mountain of national debt—it means interest payments are ballooning. That could crowd out spending on things like infrastructure, education, and social programs.

Then there’s the risk to markets. Investors tend to treat U.S. Treasuries as the foundation of the financial system—ultra-safe and always reliable. But when yields swing higher and stay there, it can create volatility in other areas. Think of banks, which often hold large amounts of long-term bonds. If yields stay high, the value of those bonds drops, potentially putting pressure on balance sheets (yes, think back to the regional banking hiccups in 2023).

Lastly, the global implications shouldn’t be ignored. Higher U.S. yields attract foreign capital, which strengthens the dollar. That might sound good, but it can hammer emerging markets whose debt is denominated in dollars. It also makes U.S. exports more expensive, potentially weighing on the economy over time.

So, while “higher for longer” might just sound like another economic buzzword, it’s worth watching closely. It’s not just about interest rates—it’s about the ripple effects that can impact everything from your mortgage to your 401(k). Buckle up, because this ride may not slow down anytime soon.

Great breakdown of the "higher for longer" bond market situation! You've perfectly captured how this seemingly dry financial term actually impacts everything from mortgages to global markets. The ripple effects you described - from corporate debt refinancing to emerging market pressures - really highlight why this matters beyond Wall Street.

That regional banking "hiccup" callback was particularly clever - sometimes a little financial history repeats itself in unexpected ways! Your explanation makes complex market mechanics feel accessible and relevant to everyday finances.

The dollar strengthening effect is such an important point that often gets overlooked in these discussions. As you noted, what might seem like good news for the U.S. can create real headaches globally.

Excellent analysis overall - you've taken a wonky financial concept and shown why we should all be paying attention. That bond market rollercoaster analogy feels particularly apt these days!