Bitcoin close to reaching its last high. However, it experiences high volatility due to macroeconomic uncertainty

MARIOLA GROBELSKA | Unsplash

Last week Bitcoin had its volatility points in the $100,000 range, which led us to think that it would not be long before reaching a new high. Regarding this week, its volatility is even higher, with a 2.5% increase that took its price to $106,500. However, after that close to its last high, the price headed towards $102,450 dollars, representing a drop of 3.8%.

Bitcoin Price | CoinGecko - TradingView

This makes us assume that something is happening on a geopolitical level, and rightly so. If we recall, one indicator that affected Bitcoin's stability was Trump's tariffs that had been imposed on several countries, provoking a trade war. Finally it transpired that earlier this month there was an agreement between the United States and the United Kingdom. Recently there was an agreement with China for the reduction of tariffs affecting both sides.

However, there are still concerns regarding tariffs. It appears that those decisions that have been made by Trump have affected unemployment rates and inflation rates; something that the Fed considered to be the effects of a tariff war. The result of this equation prompted Walmart to announce a plan to raise prices as a reflection of the import tariffs.

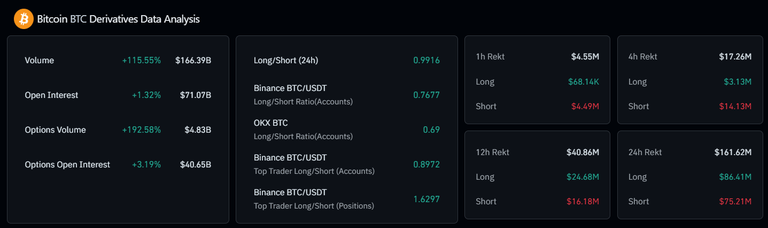

Bitcoin BTC Derivatives Data Analysis | CoinGlass

Bitcoin, meanwhile, is experiencing a $161.62 million position liquidation, according to data provided by CoinGlass. Liquidations happen when traders' positions are exceeded by the price volatility, going out of the margin in which they planned to operate, so that a closing of the operation occurs.

Taking this into account, we can assure by looking at the data, that in the last 24 hours there have been long liquidations for about $86.41 million dollars, while short liquidations for about $75.21 million dollars. These liquidations, in addition to being caused by extreme volatility, are also due to the way in which the user trades. If the user trades with a very high leverage, the margin is reduced, so it is more likely that the position will be liquidated, although it results in higher profits if the study made by the trader is correct and is in line with how the market moves.

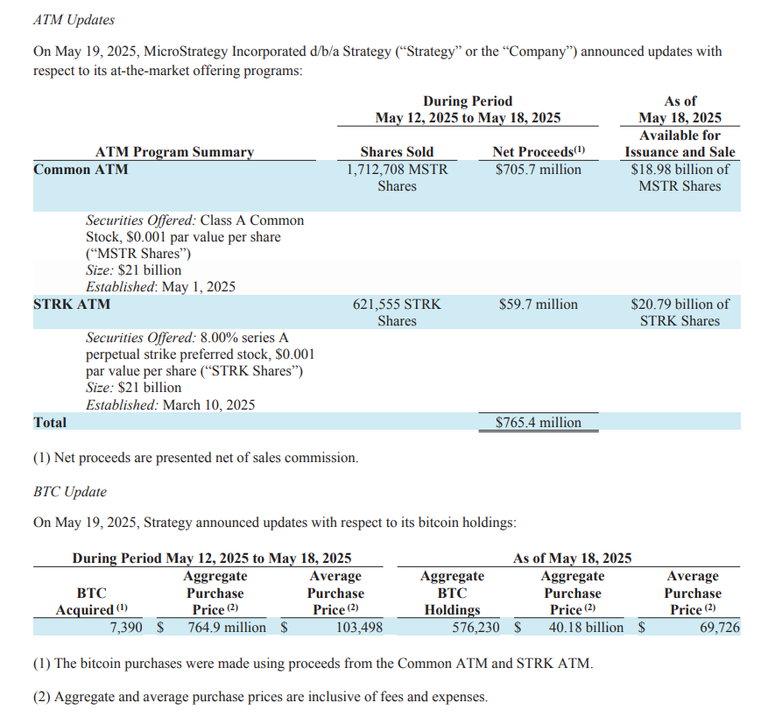

The price drop we are currently experiencing is probably due to a class action lawsuit against the firm led by Michael Saylor, MicroStrategy. The lawsuit filed by the Pomerantz law firm in the U.S. District Court alleges deception of investors. In a bid to double down, MicroStrategy announced the acquisition of $765.4 million in BTC.

Form-8-K document on strategy.com official site

Bitcoin is currently down 0.7% in 24 hours, with a significant volume that is close to $50 billion dollars (punctually it is currently about $49.57 billion dollars). We are likely to continue to see high volatility in the price of BTC, at least until there are no positive developments regarding the unemployment and inflation rate, as well as no changes in the Federal Reserve's policies, maintaining an interest rate between 4.25% and 4.50%.

This would mean that people would enter into such uncertainty that they would prefer to direct funds towards safe ground such as bonds, and not expose themselves to highly volatile or risky assets. Bitcoin could also be considered as a safe haven asset, although it is likely that those who opt for this option will be investors with a great deal of experience in the cryptocurrency market.

- Main image edited in Canva.

- Information has been consulted from: decrypt.co and globenewswire.com.

- Translated to English with DeepL.

Posted Using INLEO

https://www.reddit.com/r/CryptoNews/comments/1kqj78e/bitcoin_close_to_reaching_its_last_high_however/

This post has been shared on Reddit through the HivePosh initiative.