The SEC reserves the right to challenge FTX's proposed payments to creditors in stablecoins

Tingey Injury Law Firm | Unsplash

Stablecoins are beginning to be considered as a form of payment worldwide. It is a cryptocurrency that is tied to a fiat currency, although each one has its own strategy to achieve stability.

Let us bear in mind that cryptocurrencies are known for their volatility, which is something the market takes into great consideration to maximize profits. In the case of stablecoins, it is a currency that aims to maintain an accumulated value.

If we had to mention a stable cryptocurrency, we would probably talk about a very well-known one today, practically the most popular; Tether USDT. In this particular case, it maintains a correlation with the US dollar through a real reserve.

As we mentioned earlier, stablecoins could be useful for making important payments, although one of the most influential regulators today seems not to fully agree on certain aspects.

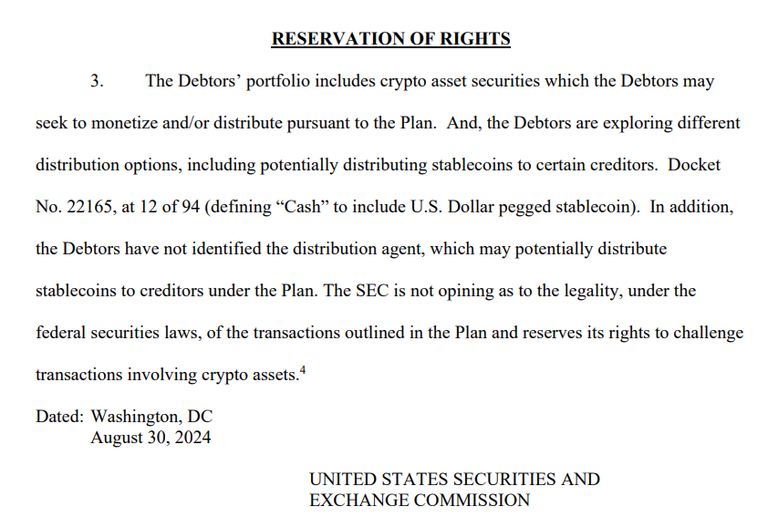

The United States Securities and Exchange Commission (SEC) made a reservation of rights in which it could oppose certain proposals from FTX's plan by the debtors.

On Friday, a court record was published where the document outlines the FTX case and how they plan to compensate creditors. It should be noted that this exchange has been involved in a scheme of scams or defrauding towards the platform's customers and investors. For this reason, the SEC had filed lawsuits against FTX Trading Ltd, which is a precedent to consider.

Following the bankruptcy of FTX in 2022 that resonated across all finance portals, a plan was agreed upon to repay creditors for a massive sum ranging from $14.5 billion to $16.3 billion to be executed in May 2024.

In this restructuring plan, a 118% cash repayment was claimed, although those eligible for refunds had amounts under $50,000.

There seem to be certain contradictions from the SEC. For example, in a previous case, it was stated that cash included coins linked to the US dollar (stablecoin), in addition to traditional payments such as checks and bank deposits. Continuing with this example, one could start to wonder what the issue is here, or if it is a direct attack on that platform, denying a payment that nowadays should be considered just another form of payment.

It is true that there are laws involved and that maximum legal coverage is sought, although this is something the SEC is not commenting on in this particular case. In case transactions are made through crypto assets, the regulator could challenge them, as explicitly stated in the document.

There is much discussion about whether a currency is considered a security or constructed with the intention of promoting an investment contract. There might not be a definitive answer to that, as the uses that will be obtained over time could imply that any type of platform knows what product to offer or what to do with it. However, it's as simple as focusing on the traditional use, which is to save, accumulate, or simply make transfers and payments for a common purpose, as if one had cash.

In July 2024, BlockFi issued token refunds to customers using CoinBase as a means. This company, after going bankrupt, decided to compensate its customers with cryptocurrencies instead of opting for cash. This could be a clear example to consider by the SEC and see what resolution it has regarding FTX. Although everything seems to indicate that the decision has been made and there is no turning back.

- Main image edited in Canva.

- I have consulted information in decrypt.co.

- I have used Hive Translator to translate from Spanish to English.

Posted Using InLeo Alpha

This 'SEC' everyday. Why try to stud crypto payments strategy. At first, what actually did FTX customers lose, 'fiat or crypto' the later is the case. I don't think the customers will be unhappy if they get back their money still in crypto. Just hoping this doesn't bring in some delays.

I understand that as a regulatory entity you have to make some interpretations about cryptocurrencies and their correct use. Although there are times when they seem to be looking for some way to damage the reputation of the crypto market.

Although there are times when they seem to be looking for some way to damage the reputation of the crypto market. Most of time this seems to be their aim