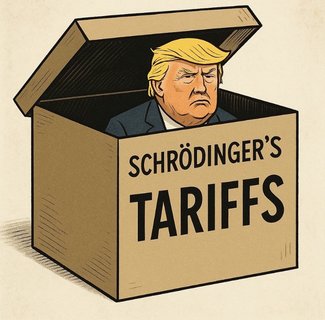

Tariffs

Dear Hiveans,

everybody and his great aunt has already uttered his opinion about tariffs. So I'd like to add some loose thoughts about them, too.

Most people know that according to economic theory, tariffs damage the economy, for instance by

- slowing economy and higher risk for recession

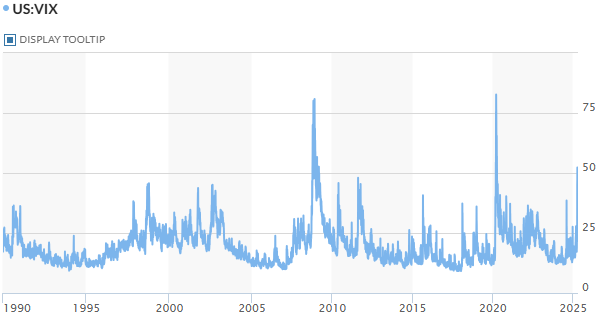

- increased investor uncertainty and market volatility

- negative impacts on manufacturing due to higher costs for resources and intermediate products

- global trade tensions

- currency concerns (volatility)

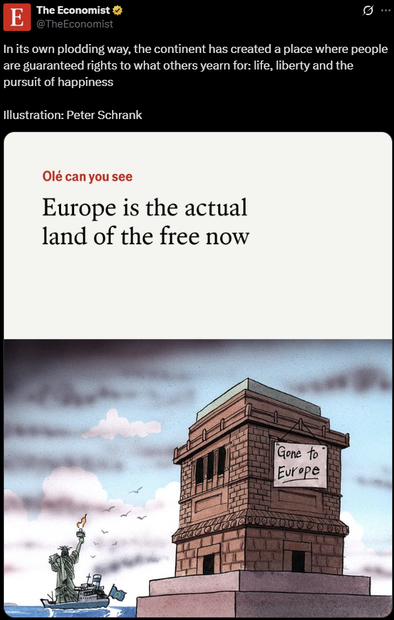

What I find funny is that - suddenly - all those socialists, socialist "democrats", mercantilists, and CCP-supporters have discovered classical-liberal arguments in favor of free trade. Astonishing! Where were those arguments when basic freedom was attacked time and again (long-term lockdowns, vaccine mandates, high taxes, rampant regulation, arbitrary energy subsidies and/or bans, ...)?

I don't know Trump's real intentions. Is it to exclude or marginalize China in world trade (with the consequence of weakening them militarily)? Or is it to reshore manufacturing to the US, in addition to generating some tariff income?

There are so many things that have damaged American (and European) productivity and led to outsourcing to China and others, from extortion by trade unions, governmental coercion / regulation via red tape against technological progress (e.g. concerning energy or things like the Jones Act (wiki)) or by admitting China to the WTO. "Liberals" supported that (not least by admitting China to the WTO by Clinton, source). With acts like those the Democrats betrayed their core electorate. Wall Street profited by increased margins (due to cheap labor), main street suffered.

Though I oppose tariffs in general, as a risk manager in the investment sector I find this "tariff action" highly intriguing. What will be the consequences concerning the US Dollar (which has fallen quite a bit, probably with intent by the US gov), the stock market, the economy overall, employment, or even war (if China feels being in existential danger)?

The yield curve has steepened in the last weeks, which increases the risk of a recession (grey columns). But is that bad? I think we had too few recessions in the last years (please read that) and that many unprofitable companies need to be liquidated in order to free up resources (money, commodities, employee's time) for new creative, productive companies.

This is not to say Trump is right - far from it. His behavior seems combative, inconsistent and arbitrary, increases (at least short-term) uncertainty and shakes the market (maybe he just let some air out of the bubble). Meanwhile the media are as unhinged, confused and reality-twisting - as we've seen for years now...

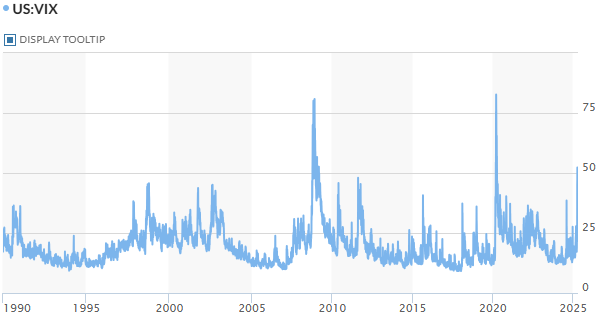

The volatility index VIX peaked 2 weeks ago at a level below the great financial crisis of 2008 and the Covid crash in March 2020.

But I'd expect higher volatility later this year, with a recession, higher unemployment and a lot of pain. Who will be to blame - Trump? Powell? 40 years of irresponsible debt creation by weak men? (or the usual suspects like the Jews and the rich?)

Please stay safe and have a great day,

zuerich

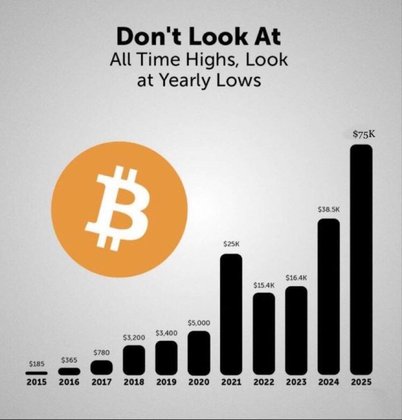

Memes...

Liebe Hiver,

jeder und seine Großtante hat sich bereits zu den Zöllen geäußert. Nun möchte ich auch ein paar lose Gedanken dazu äußern.

Die meisten Menschen wissen, dass Zölle laut Wirtschaftstheorie schädlich sind, zum Beispiel durch

- Verlangsamung der Wirtschaft und höheres Rezessionsrisiko

- erhöhte Unsicherheit für Investoren und Marktvolatilität

- negative Auswirkungen auf das verarbeitende Gewerbe aufgrund höherer Kosten für Ressourcen und Zwischenprodukte

- globale Handelsspannungen

- Währungssorgen (Volatilität)

Was ich lustig finde, ist, dass - plötzlich - all diese Sozialisten, Sozialdemokraten, Merkantilisten und Anhänger der Kommunistischen Partei Chinas klassisch-liberale Argumente für den Freihandel entdeckt haben. Erstaunlich! Wo waren diese Argumente, als die Freiheit immer wieder angegriffen wurde (Lockdowns, Impfpflicht, hohe Steuern, ausufernde Regulierung, willkürliche Energiesubventionen bzw. Verbote, ...)?

Ich kenne Trumps wahre Absichten nicht. Geht es darum, China aus dem Welthandel auszuschließen oder an den Rand zu drängen (mit der Folge einer militärischen Schwächung des Landes)? Oder geht es darum, Produktion in die USA zurückzuholen, und zusätzlich Zolleinnahmen zu generieren?

Es gibt so viele Dinge, die der amerikanischen (und europäischen) Produktivität geschadet und zur Auslagerung nach China und in andere Länder geführt haben, von der Erpressung durch Gewerkschaften über staatlichen Zwang/Regulierung durch Bürokratismus gegen den technologischen Fortschritt (z. B. in Bezug auf Energie oder Dinge wie das Jones-Gesetz (wiki)) bis hin zur Aufnahme Chinas in die WTO. Die Demokraten haben das unterstützt (nicht zuletzt durch die Aufnahme Chinas in die WTO durch Clinton, Quelle). Mit solchen Handlungen verrieten die Demokraten ihre Stammwählerschaft. Die Wall Street profitierte durch höhere Gewinnspannen (aufgrund der billigen Arbeitskräfte), der einfache Bürger litt.

Obwohl ich generell gegen Zölle bin, finde ich als Risikomanager im Investmentbereich diese „Zollaktion“ höchst interessant. Welche Folgen wird das für den US-Dollar haben (der, von der US-Regierung beabsichtigt, ziemlich stark gefallen ist), für den Aktienmarkt, die Wirtschaft insgesamt, die Beschäftigung oder sogar einen Krieg (wenn China sich in existenzieller Gefahr sieht)?

Die Zinskurve ist in den letzten Wochen steiler geworden, was das Risiko einer Rezession erhöht (graue Säulen). Aber ist das schlecht? Ich denke, dass wir in den letzten Jahren zu wenige Rezessionen hatten (bitte lesen) und dass viele unrentable Unternehmen liquidiert werden müssen, um Ressourcen (Geld, Rohstoffe, Mitarbeiter) für neue kreative, produktive Unternehmen freizusetzen.

Das soll nicht heißen, dass Trump Recht hat - weit gefehlt. Sein Verhalten erscheint aggressiv, inkonsequent und willkürlich zu sein, erhöht (zumindest kurzfristig) die Unsicherheit und erschüttert den Markt (vielleicht hat er auch nur etwas Luft aus der Blase gelassen). Die Medien sind derweil genauso verwirrt und realitätsverdrehend, wie wir es schon seit Jahren erleben...

Der Volatilitätsindex VIX erreichte vor 2 Wochen einen Höchststand, der aber unter dem Niveau der Finanzkrise von 2008 und des Covid-Crashs im März 2020 liegt.

Aber ich erwarte eine höhere Volatilität im weiteren Verlauf dieses Jahres, mit einer Rezession, höherer Arbeitslosigkeit und viel Schmerz. Wer wird daran schuld sein - Trump? Powell? 40 Jahre unverantwortliche Schuldenmacherei durch schwache Männer? (oder die üblichen Verdächtigen wie die Juden und die Reichen?)

Please stay safe and have a nice day,

zuerich

Memes...

Except his inner circle and maybe friends, I think no one knows. We can only speculate with what he says in his tirades of interviews and other public statements. China for me, seems to be the bone of contention for Trump. The Canadians and co might give in, no matter how emotionally agree that becomes, but the Chinese feels they have everything to go on a retaliatory tariff yo-yo with Trump.

They consider themselves economically equipped, and personally I feel that Trump doesn't like this.

I've read a few other people on the tariff issue, mostly about how it seems to positively impact importation for my country's businessmen, as Trump’s country and China appear to be in some sort of competition. But I suppose that’s for their own benefit, it might have negative effects on others.

https://www.reddit.com/r/economy/comments/1k62o1q/tariffs_everybody_and_his_great_aunt_has_already/

The rewards earned on this comment will go directly to the people( @uwelang ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Guten tag, Dear my friend @zuerich !

East Asians like me speculate that Trump could cause China to attack Taiwan, which could spark a war with Japan.

Russia has now wasted all its energy on the war in Ukraine, so it will not be able to support China if there is a war between China and Japan.

I suspect China will attempt to conquer Taiwan in a limited war, without using nukes!

Japan is likely to go to war with China to prevent China's conquest of Taiwan.

If a Sino-Japanese war breaks out, South Korea could go to war with North Korea.

It is likely that China, Japan, and South Korea will not engage in a nuclear war that would destroy each other, but will instead engage in a war using only conventional forces!

But, I don't want war to break out! So, I hope my dangerous assumption is wrong!😂

Danke, gut!

Hehe. Ja, ich habe auch keine Ahnung, vermute aber das Englishe Sprichwort: "Moving is Life" als Hauptgrund. Soll heißen Hauptsache es Bewegt sich was, dann geht es Vorwärts nicht wahr? Ob rauf oder runter ist ja Egal, beides hat was. Nu und wie man sieht hat das scheinbar auch funktioniert bisher.

Hatter wieder Dampf gemacht der Trump. Ziel erreicht. Mehr ist es nicht. Offensichtlich.

Des Bild mit dem Chuck und ChatGPT hat mir am besten Gefallen.

Danke für deine vielen Votes und so sehr Lieb und auch gerne gesehen wenn weniger an Wert. ;-) Aber nicht, das mir noch falsche Bescheidenheit aufkommt.^^

Liebe Grüße

Sascha

I'm going to say 'Trump administration' because I think Trump is just a figurehead for a faction of corporate power. The Trump administration wants a weaker dollar to improve exports and balance the horrific debt load America suffers. I think that's what the tariffs are about, improving America's exports. China didn't just up and agree to drop their tariffs on American goods, so that tactic didn't work in China, but it did in a lot of other countries. We'll see if America gets back to manufacturing or not, and if the Trump administration can find a way to ease the tariffs on American exports to China. Higher tariffs on China didn't work.

Thanks!

Internet payments are on track to surpass military expenses. The long term solution is embracing the free market, abolishing FED and all the other things that we have been screaming about. That won't happen yet. This administration has enough people in it that would want to tackle this massive debt problem. A lot of things start to make sense when you look at things this way.

https://www.investopedia.com/why-interest-payments-are-blowing-up-the-federal-budget-8712197

Another factor to consider is that Trump administration may not care too much about what happen to USA as long as other countries have it worse. They likely think of this similar to a boxing match. They will tolerate any pain as long as they can improve the relative position of USA compared to other nations.

I appreciate your rational consideration. Too often people get tied up in politics, when that's merely a tactic useful to domestically control polities, and geopolitical considerations require peering into the relative void of reason and economic power beyond domestic policy.

Thanks!

I try my best to see the bigger picture. I can hardly affect geopolitics. If I can at least expect what could happen, I can get ready and inform at least a few more individuals.

!LOL

Posted using MemeHive

lolztoken.com

A synonym roll.

Credit: reddit

@zuerich, I sent you an $LOLZ on behalf of memehive

(1/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

This economic situation you explain is the truth. These high tariff rates will increase the high cost of living. There will be economic recessions, devaluation of the currency of different countries. Every day I pray and pray to God that this economic situation in the world will be fixed. Have a happy day, together with your family. May God bless you and give you good health.

Well, I am also puzzled by this:

I thought memes were just for fun and sarcasm. I didn't expect that memes can be factual and intellectual. 😄

!PIZZA

!LOLZ

lolztoken.com

He needs me to get him out of jail.

Credit: vaipraonde

@zuerich, I sent you an $LOLZ on behalf of kopiko-blanca

(3/6)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

$PIZZA slices delivered:

@kopiko-blanca(3/5) tipped @zuerich

Come get MOONed!

Congratulations @zuerich! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 170000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

The tariffs saga was really a lot to deal it, the dust may seem to have settle for now bust for how long? In two months time we all go back to the whole drama and ranting again. I also question Trump’s intentions with all the tarring drama . I feel his just playing a pun for his own pockets

Trump has withdrew his support for most of the developing countries most especially in Africa. Thanks for sharing