When Can Tax Authorities Grab Your Crypto?

I have often wondered what it would be like to be a fully fledged crypto trader. Due to various circumstances and things happening in my life I have never been able to seriously consider it. But perhaps I should. Perhaps more of us should.

It goes without saying there is lots to consider when making a decision of that nature and you really do need to know what you're doing if you intend to make your living from crypto. But many people have clearly made that decision and live quite comfortably off their crypto trading activities.

Therefore, it has often crossed my mind how the authorities tax crypto assets in various jurisdictions. Given how new to the financial world cryptocurrencies are you shouldn't be surprised to learn there isn't a ton of laws and legislation pertaining to cryptocurrencies. But of course governments are very keen to make sure they grab a slice of the action, in addition to having their own piece of the pie they want a slice of yours.

Cryptocurrencies and the Law - What Law?

So bit by bit regulation has crept in. For example I live in the United Kingdom and in my country all crypto exchanges now have to be regulated by the Financial Conduct Authority. Additionally since 2017 our tax agency, known as His Majesty's Revenue and Customs, which is responsible for collecting taxes has issued a copious amount of guidance for taxpayers when it comes to owning crypto assets and their tax arrangements.

You'll note that word guidance, because there is remarkably still very few laws and little legislation in Britain on the subject of crypto. To date, as far as I can tell, there is only one piece of legislation that has included a section relating to crypto, that is the Economic Crime and Corporate Transparency Act 2023.

This Act includes a small section which is designed to give law enforcement more powers to seize crypto assets when they suspect crime. But there is nothing in respect of determining what type of security crypto can be classed as when it comes to taxation. So what the authorities have done is scrape together a tax framework applicable to crypto assets from existing laws and legislation. It creates a very grey area.

Crypto Assets - Capital Gains or Income?

Before the HMRC got 'creative' crypto assets were all classed as capital gains for tax purposes. But they have developed their approach now to include income as well, and they're going further.

A new Bill has just been introduced to Parliament entitled the Property (Digital Assets etc) Bill which aims to 'clarify' the status of crypto. This bill seeks to treat crypto assets as personal property.

The Property (Digital Assets etc) Bill, introduced in Parliament today, will mean that for the first time in British history, digital holdings including cryptocurrency, non-fungible tokens such as digital art, and carbon credits can be considered as personal property under the law.

The new law will therefore also give legal protection to owners and companies against fraud and scams, while helping judges deal with complex cases where digital holdings are disputed or form part of settlements, for example in divorce cases.

It will be interesting to see how this plays out. It does seem there is a little bit of genuine protection for crypto holders going on here, so that even in crypto land if you're robbed you might be able to get your dosh back. But I would imagine it's being done to give some semblance of legitimacy to the State's efforts to pin your crypto assets to you, so the State can grab some money from you. Furthermore, to me this bill is designed to make crypto less anonymous, which is exactly what the State hates about crypto.

So, You're A Crypto Trader and You Want to Do the Right Thing?

From talking to people in the cryptosphere it seems that a lot of people have decided to go down the income tax route and not bother with the capital gains route, with the latter once being the favoured tax option.

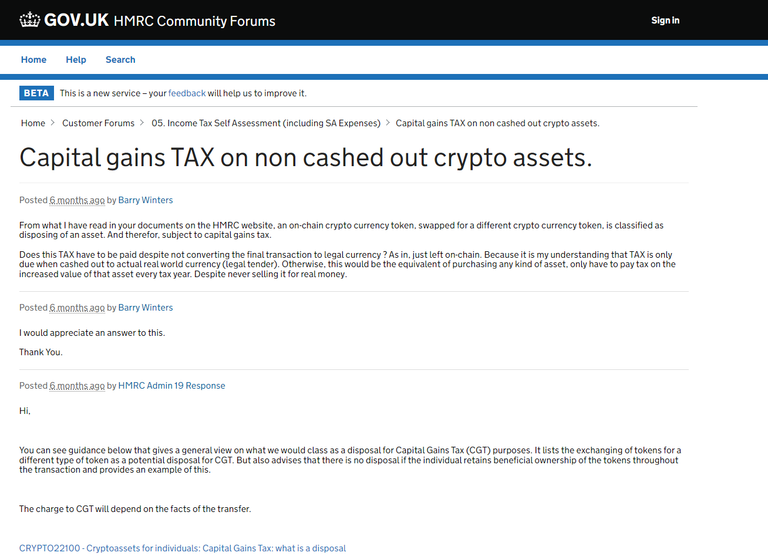

But if you are Joe Bloggs and you want to be a genuine crypto trader, keep things above board and do the right thing even that noble quest won't be as easy as you think. Take the example of a great man called Barry Winters. Around six months ago he took to the HMRC community forums to ask HMRC staff about crypto issues and taxation. Take a look.

So as you can see Barry is asking about the status of executed trades that do not dispose into fiat, where the crypto asset is simply left on the exchange. No HMRC staff member initially responds so he nudges the query. Eventually he receives a reply. From the response of the HMRC staff member all Barry is provided with is a general and vague answer directing him to 'guidance'.

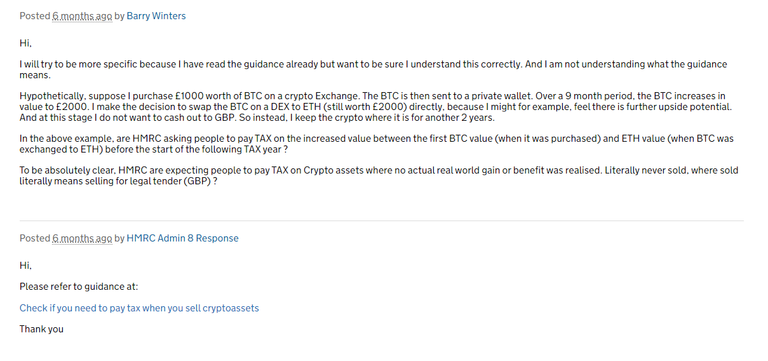

Barry makes another attempt in trying to get a more comprehensive answer and a resolution to his query, because he has read the guidance and he doesn't understand it.

As you can see from the HMRC agent who responds Barry is simply directed to more guidance. It is a pitiful response from a government agency dealing with a taxpayer who is simply trying to get specific answers so he can make the right tax arrangements for his crypto assets.

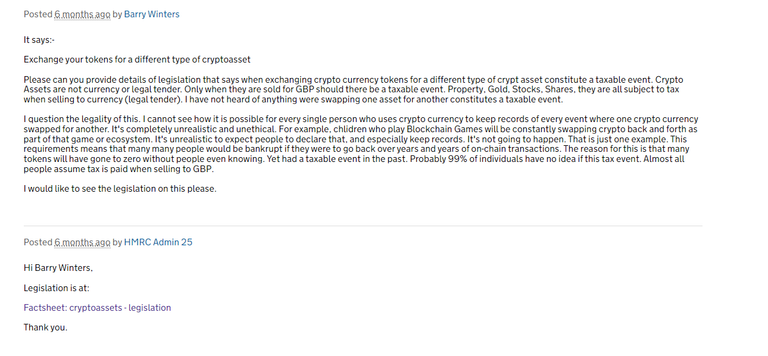

Barry is determined though and replies more firmly questioning the legality of the current position in the infamous 'guidance' citing pertinent scenarios, and he requests HMRC to direct him to specific legislation which governs this particular area of crypto and taxation. Of course there isn't any.

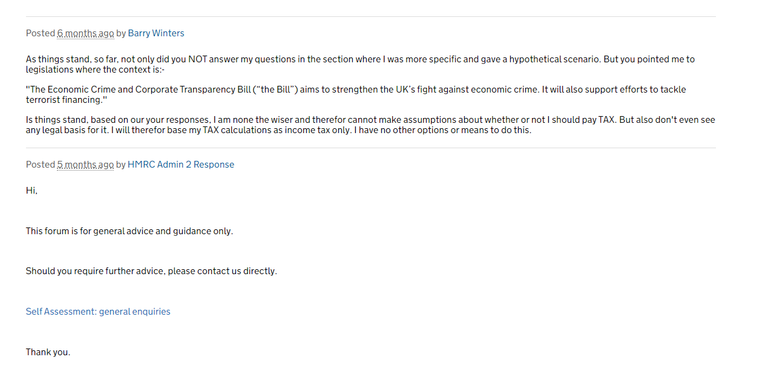

Once again Barry is met with an utterly useless response from the HMRC staff member directing him this time to a factsheet. In the end Barry gives up, can you blame him? But he leaves his parting shot and makes his feelings known. He also clearly informs HMRC he will be using the income tax model for his crypto taxation assessment. A HMRC agent responds with what is now a customary unhelpful reply.

Let's not forget reading the exchange between Barry and HMRC is the end product of a system that is perverse to the core. The one positive from this online forum HMRC provide is learning about how inept the HMRC staff actually are when it comes to their understanding of crypto assets.

So you see even when you try and do the right thing the people and powers in charge don't seem to want to really help you do the right thing, which shouldn't come as a surprise really. We are governed by very sick minded people who are doing their best to financially ruin all of us, except them.

Peace!

If I don't have the authority to write my rules down and force them onto you, and you don't have the authority to write your rules down and force them onto others, and neither of us can delegate an authority we don't have, where do the cops get their authority?

No one rules where none obey.™

But most will obey, that's the problem. Even getting to that 10% is a problem.

Once it gets bad enough, things will change.

The 'I just want to be left alones' will stand up, at some point.

When that happens, look out.

Man I hope you're right and that happens. It needs to and soon. But I still see way too many of the 'I just want to be left alones' still wanting to be left alone and avoid anything that might force them to find some courage.

When it starts it will be an avalanche.

The ones too scared to go out on their own will quickly join the mob.

Once that happens, there will be excesses.

Then people will pull back and begin making the new way the norm.

First they ignore you.

Then they ridicule you.

Then they attack you.

Then you win.

Ghandi

The attacks are showing up at the gas pump and the grocery stores.

We are about to win.

!pimp

Very helpful.

Even poor Barry's responses from HMRC are useful. Barry (patience of a saint) has my sympathies.

Hey @shanibeer, thanks for this comment and I am glad you found it helpful, I hope it may have helped others. Yes, I admire people like Barry who are determined and, as you rightly point out, have patience to see things through.

I see you're also from the UK, it's always good to meet fellow Brits on here so it's a pleasure to meet you.

Thanks again for your comment and support, it means a lot.

👍

Greetings @peaceandmoney ,

A very enlightening read....thank you.

For some reason ...Shakespeare comes to mind...^__^

Kind Regards,

Bleujay

!BBH

Thank you again @bleujay! I am slightly confused I have just had a notification for this message but it says it's 6 days old. Anyway sorry if I have missed this. Pleased you enjoyed it, I hope you managed to get some useful information from it, irrespective of what tax jurisdiction you're in.

Shakespeare eh? Blimey I didn't realise my writing was that good but thank you dear @bleujay I shall grab that compliment with both hands.

I also see you have sent me a token called BBH, I shall look further into this, thank you.

Oh yes...Bradley Arrow is the token issuer...I thought you perhaps knew of it.

BBH......Bitcoin Backed Hive....Sounds interesting right...

I can give one a day....and thought since you might have missed this reply...I would add it.

About Shakespeare....a phrase from his work had come to mind to reply with...but of course nothing quite hit the mark...however ....'What a tangled web we weave when first we practise to deceive.' may just do the trick.

Cheers, Bleujay

That's very kind of you thank you for the token, I shall do more research.

Yes of course, well said there. Tax authorities involved in deception? Surely not?!

@peaceandmoney! @bleujay likes your content! so I just sent 1 BBH to your account on behalf of @bleujay. (1/1)

(html comment removed: )

)