The everything bubble

Anyone who has been in the markets long enough knows that they are cyclical. Markets in many ways obey universal laws after all, and the very idea that it can only go up is at best naive.

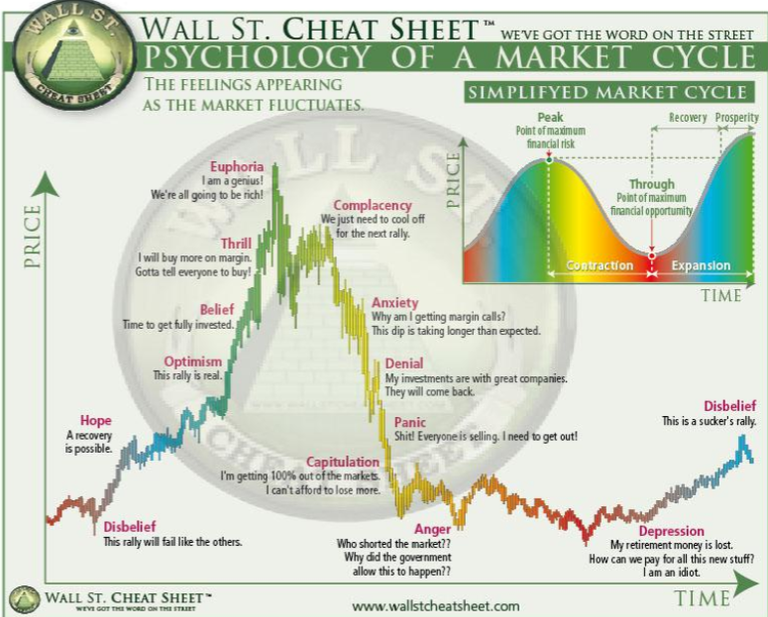

That being said, I'm not one to succumb to the words of doomsday prophets. No matter what time in history we may zoom into, we can always find people who are delusional of both sides of the emotional spectrum. But it's always a good idea to know where the balance lies as to not join team euphoria or team doom, and be as cautious as we can be with our decisions.

All that said, there are a few factors at play right now that are hard for me to ignore, and I find them extremely worrisome. Truths that we should all be aware of and adjust accordingly.

The 8 year cycles

Also known as the boom and bust, these cycles are as old as the birth of civilized society. It's not too hard to remember when the last "catastrophically bust" happened, since cryptocurrency was born of the last time the buildings burnt down. But it seems to me like most of us are pretending that was the last time they would.

Yes, there is undeniable flexibility to the timing of these cycles. It takes a few minutes of research to make this case, but they are for all intents and purposes unavoidable.

But the main question, the one that everyone would like to know with surgical accuracy is this:

Where are we now?

I can't guarantee to be right, and to be honest nobody should take an expert's word as gospel either, but I'm pretty confident we are in the Thrill stage, about to enter Euphoria.

I also won't sit here and pretend to be able to call tops, since the amount of people that get it right is miniscule to begin with, I'm not some market guru after all, but there are undeniable indicators that we are about to fall off the precipice very soon.

In the best interest of clarity, I should say that the bubble I'm talking about is literally a macro bubble. I'm not referring to a particular asset.

Buffet Indicator

I saw a video about this just the other day and it's another confirmation of what I think I know. The idea is simple, and yet it's one that up until a week ago or so, I had not known about.

The Buffett Indicator is a valuation metric used to gauge whether a country's stock market is overvalued, undervalued, or fairly valued relative to the size of its economy.

The Buffet Indicator is calculated by dividing the total market capitalization of all publicly traded stocks in a country by that country's Gross Domestic Product (GDP).

Below 50-75%: The stock market is likely undervalued. Stocks may be cheap relative to the size of the economy, potentially signaling a buying opportunity.

75-90%: The market is fairly valued. This is considered a neutral range where valuations are reasonable.

90-115%: The market is modestly overvalued. Caution may be warranted, but it’s not necessarily alarming.

Above 115-120%: The market is likely overvalued. This could indicate a bubble, where stock prices are high relative to economic output, increasing the risk of a correction.

Above 150%: The market is significantly overvalued, potentially signaling extreme risk of a crash (e.g., during the dot-com bubble).

How are we looking now?

If you guessed 150 or 160 you would be wrong, and wrong by a very long shot. As of me writing this post the number stands above 208% and if that doesn't alarm you, then I don't know what will.

The idea that we might be in a bubble has to be completely discarded to allow for the fact that we are to nest in our heads. To deny the obvious is to not ready ourselves for the consequence.

Is this time any different?

I've seen a few people making the case for the idea of us not having to worry about this new mega bubble. And, because I don't want to close myself off new ideas, I have to admit there is a tiny bit of merit to their points.

It happened slowly, but it happened. We lived in a fully globalized economy and maybe this indicator is not effective at calculating the strength of a market when other people, outside our country, can participate of the American markets. But this could possibly explain why it hasn't popped yet, and not necessarily that it wont.

MenO

A very reasonable comment on the market of the day.

I do not understand.

Thanks!

I guess it's an usual visual... to allow knowledge to get comfortable inside our heads.